Navigating the nuances of the 79 loan process can be a challenging task. However, with the proper understanding and preparation, you can successfully obtain the assistance you require. Start with, meticulously examining the requirements criteria to ensure that you fulfill them. Then, compile all the required forms and submit a detailed application. Throughout the process, maintain honest dialogue with your financial advisor.

- Regularly stay in touch

- Address any queries promptly.

- Stay patient and dedicated throughout the process.

Grasping 79 Loan Requirements and Eligibility

Securing a loan can be a complex process, significantly when dealing with less common loan types like the 79 loan. Understanding the specific requirements and eligibility criteria is crucial for a smooth application process. These loans are often structured to meet the unique needs of certain borrowers, so it's important to meticulously review the terms and conditions before applying.

To assess your eligibility for a 79 loan, lenders will typically evaluate factors like your credit history, income, debt-to-income ratio, and the purpose of the loan. Having a strong financial history is generally a requirement, as it demonstrates your ability to repay borrowed funds consistently.

It's also important to investigate different lenders and compare their interest rates to find the most favorable option for your circumstances. By understanding the 79 loan requirements and eligibility criteria, you can increase your chances of a successful application.

Advantages and Disadvantages of a 79 Loan

A loan for the amount of 79 can be a helpful tool when you need to obtain funds quickly, but it's essential to weigh the potential advantages against the drawbacks. On the bright side, a 79 loan often has simple approval criteria and can be obtained relatively rapidly. Additionally, these loans generally don't require collateral. However, it's crucial to be aware of the costly fees here associated with 79 loans, which can significantly increase your overall burden. Before accepting a 79 loan, it's highly recommended to carefully compare different lenders and their terms to ensure you're getting the best possible deal.

79 Loan Options?:

Are experiencing financial challenges?| Are you in need of some extra cash?| A 79 loan could be the solution you're searching for!{These loans offer a flexible way to secure capital quickly and easily. With affordable interest rates, you can cover your expenses without stretching your budget. To guarantee a 79 loan is right for you, it's important to carefully consider the terms and conditions. Contact a reputable lender to get more information and determine if a 79 loan is the best choice for your individual circumstances.

Maximize Your 79 Loan Application Approval

Securing a loan can be a tricky process, but with the right strategy, you can improve your chances of approval. When it comes to 79 loans, knowing the intricacies of the application process is crucial. This means thoroughly gathering all the needed documents and presenting a convincing case for your monetary situation.

- Investigate different lenders to find the best terms that suit your needs.

- Strengthen a good credit history as it plays a substantial role in loan granting.

- Provide accurate and detailed financial records to build trust with the lender.

With following these tips, you can greatly enhance your odds of a successful 79 loan application.

Comparing 79 Loans against Traditional Financing Alternatives

When looking for financial support, borrowers often encounter a selection of financing choices. Among these, 79 loans have become prevalent as a distinct funding strategy. To evaluate if a 79 loan is the right fit for your needs, it's essential to compare them with traditional financing alternatives.

Traditional financing frequently involves lenders like banks and credit unions, presenting loans secured by assets or a strong credit score. 79 loans, on the other hand, generally utilize alternative analysis methods and may have varied terms and conditions.

By meticulously scrutinizing the features of both 79 loans and traditional financing, borrowers can make an well-reasoned decision that aligns with their financial circumstances.

Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Traci Lords Then & Now!

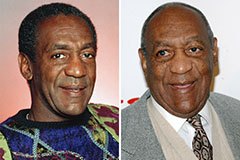

Traci Lords Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!